Deepfake Ai tech has come a long way in the last few years. It changes movie sounds and pictures so they look and sound real but they aren’t. People can be tricked or led astray by these bits of fake news. It is very easy to trick the financial markets in this way because they rely on having correct information.

Bad things can happen when deepfakes Aiare used to spread false information. Investors depend on getting accurate news to help them decide what to do. If deepfakes are used to change the truth they can make the market go crazy. There are a lot of deepfakes in the financial markets as this piece talks about.

Understanding Deepfake Ai Technology

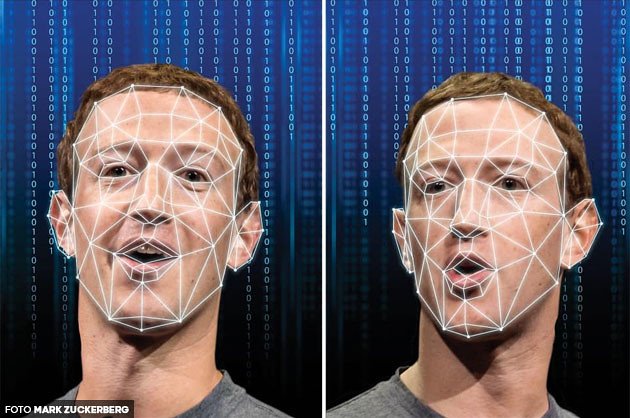

To make deepfake Ai technology work very complex machine learning techniques are used. These programs change pictures, videos and sounds to make fakes that seem and sound real. It is possible to make deepfakes Ai with deep learning models like Generative Adversarial Networks GANs. Two neural networks make up GANs. One makes fake content and the other checks to see if it is real.

The tech to make deepfakes Ai is simple to find and doesn’t cost much so anyone with basic computer skills can do it. Once they are made, deepfakes can be used to look like anyone, which makes it hard to tell the difference between real life and fake news. This can be used in clever ways but it also has a lot of risks especially when it is used in the financial markets for bad reasons.

Also Read: Raspberry Pi 5 Projects: 7 Cool Ideas for AI, Gaming & Innovation

Deepfake Risks To Financial Markets

1. Market Manipulation

The way the market works can be changed by deepfakes Ai that spread false information. People might quickly sell their shares if they see a fake video of the CEO of a company saying bad things. Stock prices may drop without notice when people believe in fake news. People might not trust them as much if they do this and it costs a lot of money. It is important to protect investors from deepfakes because they can make financial markets less safe and hurt their trust.

2. Fake News And Investor Sentiment

Deepfakes Ai can be used to make fake news that makes buyers feel different. A fake news story about a business failure or an economic problem could make people worry for no reason. People and buyers think and act differently after hearing this kind of fake news. Market trends can change a lot when people believe in fake news. This can throw off the market and lead people to make bad choices based on false information.

3. Fraudulent Activities

Fraud can be done with deepfakes Ai by making them look like real people when they do financial transactions. Bad people can make fake videos or sounds of investors or bosses in order to get private information or make deals without permission. This kind of scam could cost a lot of money. It also makes financial systems less safe because investors and businesses may not be able to tell the difference between real and fake texts.

Also Read: Best Android Gaming Accessories: Top 8 Must-Have Gadgets

Real World Threats And Incidents

Even though it doesn’t happen very often deepfakes are becoming a bigger threat to the real financial markets. In a video someone used Deepfake Ai technology to try to be a business leader which led to scams. People might not trust businesses as much if they do things like these which could cost owners money.

Besides that there have been fake earnings calls. Someone could be fooled by a fake statement which could lead them to make bad financial decisions. These kinds of events can lead to big market crashes or legal trouble if they aren’t found quickly. These threats show how important it is for the financial world to deal with the risks of deepfake Ai.

Challenges In Detecting Deepfake Ai

It is very hard for financial markets to find deepfake Ai . The tools we use to find things are getting better but they aren’t perfect yet. Sounds and movies that are deepfake Ai often look and sound so real that real people can’t tell the difference. AI systems that are designed to find deepfakes have a hard time keeping up with material that keeps getting better.

For tools used to find deepfakes Ai to keep up they need to change quickly as well. The fact that deepfake Ai are hard to spot means that the damage they do to markets may already be done when they are found. This is proof of how badly we need better and faster ways to find things.

Regulatory And Legal Implications

In the financial markets it is hard to keep deepfake Ai technology under control. We don’t have enough rules to handle the special issues that deepfakes Ai bring up. FMI officials have a tough time telling the difference between real news and news that has been changed. It is harder to catch or punish people who use deepfakes Ai to trick other people because of this gap.

To make this right we need new rules that will stop deepfake abuse in the money markets. Laws like these should keep an eye on the market, stop scams and punish people who break the law. If there aren’t clear rules the chance of the financial markets becoming unstable will keep going up.

Preventive Measures And Solutions

To stop problems caused by deepfakes Ai financial companies need to use new tools. Some tools use AI to find fake news that can help find it before it hurts the market. Companies that deal with money should buy tools that check news sources all the time. With blockchain technology messages and deals can be recorded in a way that can’t be changed.

These steps can help you see if the news about money is true. Also people who work in banking should learn how to spot deepfakes. Tech companies and the government need to work together to figure things out. In order to keep the market honest precautions must be taken.

Also Read: Crypto Philanthropy: A New Era of Giving In 2025

Conclusion

Because of deepfake Ai technology the stock markets are in great danger. It can swing the market and lose investors’ money because it has control over the media and can spread fake information. Deepfake Ai are being found better but there is still a long way to go. Banks, the government and tech companies need to work together to make things better. We need tighter rules, better ways to find problems and more people to know about them to keep the financial markets safe.